Press reports suggest that during the upcoming IMF/World Bank meeting a new proposal will be made by the US administration regarding the potential use of Russia’s frozen assets to finance Ukraine’s resistance. Let’s recap the current position.

On the one hand, according to the US, the roughly USD 300bn in frozen Russian assets should be seized and used to finance Ukraine’s military efforts. This could be particularly relevant as the House of Representatives, now led by the pro-Trump Speaker Mike Johnson, is refusing to ratify the new financial aid approved by the Senate, where the Democratic Party still holds a majority. Even the UK foreign minister David Cameron has flown to the US to try and convince the Republicans, including the de-facto presidential candidate Donald Trump, to unlock these funds, which could prove vital for the survival of Ukraine.

So, according to this line of thought, considering Russia’s illegal invasion of Ukraine, the US and its allies (let’s call them “the West”) should simply seize the assets, then use the proceeds from the potential sale to buy the weapons Ukraine so desperately needs to resist the spring-summer 2024 offensive that Russia is about to launch to get as close as possible to Odesa and Transnistria. Opponents of this view fear that if the West reacts to an illegal action by Russia with an equally illegal action such as the arbitrary seizure of Russian frozen assets, the West would lose its purported moral superiority, which is necessary for the US to continue to be an effective global financial centre led by the rule of law.

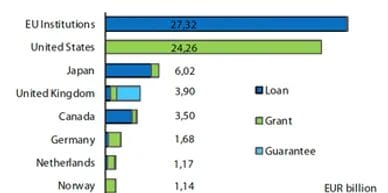

On the other hand, there are the Europeans. Most of the frozen Russian assets are in the EU, including roughly EUR 190bn of Russia’s central bank assets that are held at Euroclear, a central securities depository based in Brussels. These assets have generated EUR 3.85bn in profits since the beginning of the war in Ukraine.

EU countries had been discussing the possibility of deploying these profits to support Ukraine. The Europeans believe that authorities should not seize the entirety of the assets, but only the returns deriving from them. This is to avoid breaking international law and confidence in Western financial markets.

As a potential solution, the Biden administration is proposing a compromise. The West would only seize the profits from the assets, but will be able to collect the discounted Net Present Value of these profits through financial instruments such as loans that will be repaid over the next 15-20 years. This would allow them to respect international law, while “super-sizing” the value of these income flows over time. The US administration hopes to put this proposal on the table at the upcoming IMF/World Bank meetings that will be starting this week in DC, and to get a final approval by the G7 meeting in Italy in June.

Apart from the technicalities, the West needs to be wary about arbitrarily seizing Russian assets. No one denies that the aggression on Ukraine, apart from being brutal, is also illegal and unjustified. But the West has the responsibility of keeping a world order that is rational, just, and governed by the rule of law, not the whims of a dictator, as occurs in Russia or the China-led bloc. In particular, at a time when the de-dollarisation process is in full swing, the West needs to show that assets held in the West are safe and cannot be arbitrarily seized. Otherwise, the West may win a battle, but ultimately lose the war over which economic and financial system should prevail in the medium term.