A few weeks ago, we discussed how the geopolitical landscape was in flux, with the re-organisation of international alliances and a new world order emerging as a result of the war in Ukraine. In particular, with Russia siding with China in a Cold War II between the US and China, a polarisation of the world has emerged.

As part of this broader re-arrangement of the world order, we discussed how a new gathering of seven countries, formed around the BRICS group, emerged; we labelled this the EM G7. Besides China, Russia, India, Brazil and South Africa, two additional countries were invited as observers. One is Saudi Arabia, with which China has just formed a new strategic partnership, as we discussed in our recent column.

The other country is Argentina. As discussed in our recent in-depth analysis of the country, Argentina is undergoing a difficult macroeconomic period, characterised by slow growth, high inflation and high interest rates, with political turmoil on the horizon given the presidential election occurring at the end of the year.

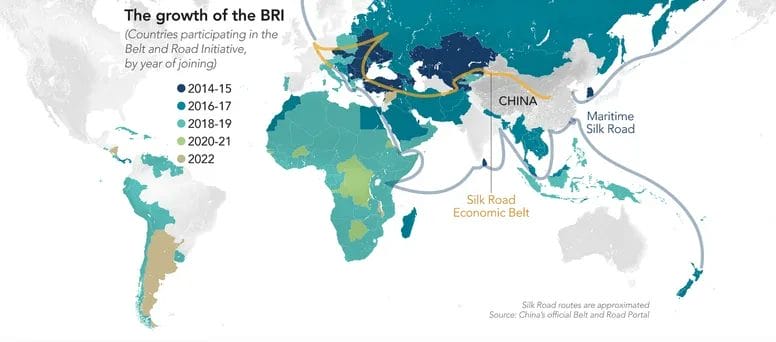

As we said, the main reason to have Argentina in the group is because Argentina has recently joined China’s Belt and Road Initiative (BRI). With Argentina in the BRI and Brazil in the BRICS, China has extended its influence over the entire Latin American region, through its two largest countries. Among others, Chile and Peru are also part of the BRI, giving China influence over the entire west coast of South America.

Now Brazil and Argentina have announced that they intend to enter a currency union, by creating an additional currency that would run in parallel to the Brazilian real and the Argentinian peso. According to estimates by the Financial Times, this would be the second largest currency union (representing around 5% of the world GDP) after the Euro (14% of the world’s GDP), and ahead of the France’s inspired CFA franc, which is shared by several African countries and is pegged to the euro. The new currency would be yet another attempt by countries that are not totally aligned with the US to reduce their dependence on the US dollar.

All of the factors above suggest that the polarisation of the world continues and was accelerated by the war in Ukraine. Some countries are backtracking from their previously held positions. As we discussed last week, China is shifting from some of its recent positions, first on the zero-Covid policy, then on distancing itself somewhat from some of the most extreme positions of Russia, and finally on re-opening a dialogue with the private sector, after the witch-hunting of the country’s tech companies and private-led education that took place during the last couple of years.

On the other side of the equation, Germany has announced that before sending more of its Leopard tanks to Ukraine, it will want to run a full analysis of its inventory. This is a way of buying time and sending a signal to Russia that it does not want to espouse the most extreme position of NATO countries. So, while China puts some distance between itself and Russia, Germany gets a bit closer to Russia, or at least reduces its distance.

These are all proofs that the geopolitical environment is in flux, but is solidifying towards a polarisation of the world, symbolised by the ongoing Cold War II between the US and China.