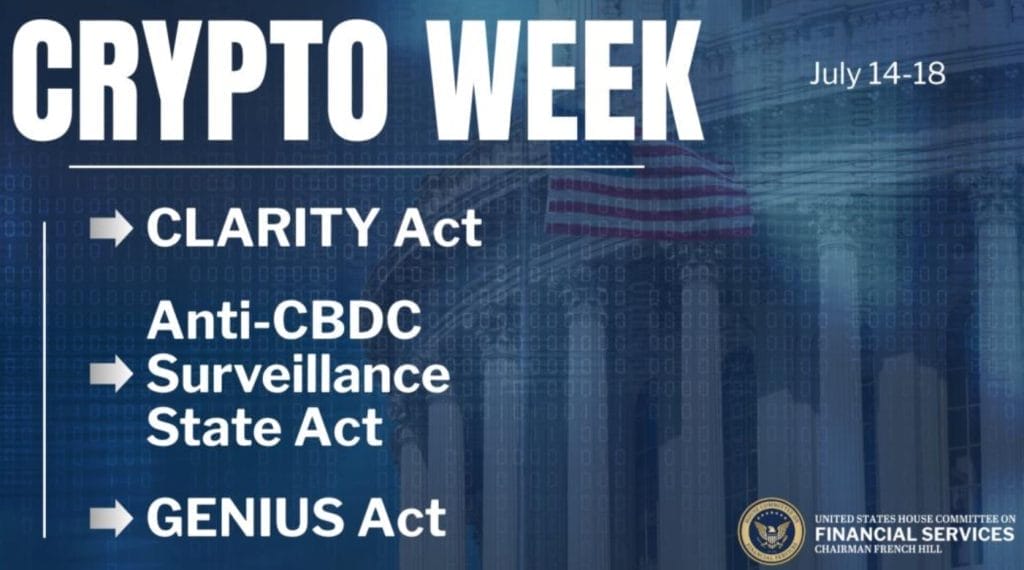

The past week was dubbed “crypto week” in the US, given the raft of events, announcements, and legislation related to the digital asset space that took place. Here we’ve selected five of these to discuss:

GENIUS ACT: The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act was approved by the House of Representatives, after the Senate approved it with bipartisan support (68-30 votes) a few weeks ago. The Act aims at regulating and legalizing “stablecoins” (crypto assets linked to US dollars) by specifying the type of approved issuers; the 1:1 backing by approved liquid assets (like short-term US Treasuries) and US dollars; the required KYC/AML/sanctions controls and monitoring; the Federal oversight which will be carried out by the Federal Office of Comptroller of Currency (OCC, an agency of the US Treasury Department). By approving the GENIUS ACT, the House has de-facto prioritised it over the STABLE Act, which was discussed in the House.

CLARITY ACT: The Digital Asset CLARITY Act, which the House passed alongside GENIUS, critically defines when a cryptocurrency is a security or a commodity, addresses the market structure for the listing and trading of digital assets, including the roles of intermediaries and trading platforms, and provides both the SEC and CFTC with regulatory jurisdiction over certain entities, products, and activities.

Anti-CBDC ACT: The Anti-CBDC Surveillance State Act codifies the Executive Order issued on 23 January 2025 and “prohibits a Federal Reserve bank from offering products or services directly to an individual, maintaining an account on behalf of an individual, or issuing a central bank digital currency (i.e., a digital dollar). Further, the Board of Governors of the Federal Reserve System is prohibited from using a central bank digital currency to implement monetary policy or from testing, studying, creating, or implementing a central bank digital currency, with exceptions as provided by the bill.”

SEC-FDIC-OCC: Besides these three pieces of legislation, there was the joint statement issued by the SEC, FDIC, and OCC, on “Risk-Management Considerations for Crypto-Asset Safekeeping.” The joint statement discusses existing risk-management principles that apply to crypto-asset safekeeping, and reminds banks that they should provide these services in a safe and sound manner in compliance with applicable laws and regulations, without requiring additional authorisation. With the new statement, crypto custody is allowed, with no extra supervision required. Sub-custody is also permitted, including through technical service providers.

Banks’ Quarterly Results and Digital Assets Strategy: Major US banks also issued their quarterly results this week, which were impacted by the continuing trade and geopolitical tensions, yet remained largely positive. Together with the standard reporting, US banks took the changes of the “crypto week” to unveil their longer-term digital-asset strategies. Among the largest banks, JP Morgan is active on stablecoins and tokenised deposits, as is Citigroup, which is also exploring reserve management for stablecoins, the on and off ramps from cash and coin, backwards and forwards. Bank of America will issue its own stablecoin, while participating also in a consortium to issue another stablecoin.

With these decisions, the US has made a leap forward in the digital asset space, taking a very bold approach compared to the prudent EU legislation of the MiCA (Market in Crypto Assets) Regulation. The US Treasury is also set to benefit from the issuance of stablecoins, as issuers will have to buy Treasury bills to back their coins. A possible conflict of interest with the fact that the OCC, which is the body overseeing stablecoins, is also an agency of the Treasury, may raise financial stability concerns. Our future analysis will discuss these risks in greater detail.